The crisis-induced slowdown in economic growth has had an inevitable impact on Malaysias social sphere as well. Malaysian economy in the fourth quarter of 2008.

All About Malaria Infographic Malaria Infographic Infographic Health Malaria

Export and industrial outputs deteriorated and investments declined.

. While employment growth had been growing steadily at 49 and 46 per cent in. Effects on global stock markets due to the crisis have been dramatic. 3 Dr Michael Lim Global Financial Crisis and Impact on Malaysia 5 th August 2008.

The financial crisis of 2008 or Global Financial Crisis was a severe worldwide economic crisis that occurred in the early 21st century. The Republic of Korea Korea. The chapter analyzes the impact of the current crisis on the.

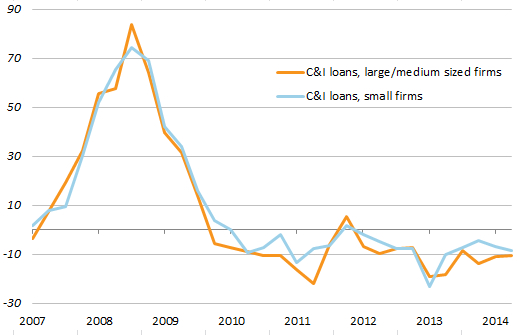

Outstanding loans expanded at an annual rate of 101 between July 2007 and July 2009. Corporations had suffered about 8 trillion in losses as their holdings declined in value from 20 trillion to 12 trillion. This chapter argues that Malaysia being a small open economy with a strong export-dependent manufacturing sector was particularly vulnerable to the global financial crisis.

Between 1 January and 11 October 2008 owners of stocks in US. The global financial crisis has evidenced sluggish progress in the growth of Malaysian banking sectors assets deposits and loans. The financial market experienced the largest percentage drop in the history of Dow Jones.

The contraction in GDP resulted in the retarda-tion of employment growth and the rise of unemployment and retrenchment lev-els. The global financial crisis is transmitted to Malaysia mainly through the financial and trade channels James et al 2008. As a result the growth.

This chapter discusses the importance of trade to the economy and Malaysiafs reliance on demand generated by developed economies. Extreme Volatility in Malaysian Ringgit has roots in the 2008 Financial Crisis. The 2008 financial crisis was the worst economic disaster since the Great Depression of 1929.

The causes and impacts have been discussed in a structured manner. The paper Asia in the World Economy - Impact of the 2008 Global Financial Crisis on Malaysia is a dramatic variant of the case study on macro microeconomics. Libya Iraq Nigeria Sudan and Syria.

The crisis led to the Great Recession where housing prices dropped more than the price plunge during the Great Depression. The quality of banking system loans folio has show an improvement and it is one of the evidence about the stability financial banking system in Malaysia. Two years after the recession ended.

The collapse of oil destabilized many developing nations dependent on stable oil prices. Crisis unveiled The 2008 Financial Crisis is the worst economic disaster since the Great Depression of 1929. Besides during the economic crisis in 2008 the bank system has a sufficient capital to recovery from the crisis and Malaysian authorities had limited exposure to foreign bank borrowing.

As a result of over production the global oil market collapsed. Impact of the banking crisis on bank intermediation The financial intermediation process in the Malaysian financial system has remained orderly throughout the period of economic turbulence with continuing flows of credit to the real economy. It occurred despite the efforts of the Federal Reserve and the US.

This can be why the effect of the second crisis wasnt as bad as that of the primary crisis but of the region. In reality in 2005 services investment recorded RM577 billion in 2006 RM555 billion and in 2007 RM664 billion before the onset of the crisis MIDA 2008. GDP growth slowed down to 01 in the last quarter of 2008 and.

And Malaysia reverted to levels consistent with trends prior to the crisis. The global financial crisis was transmitted to Malaysia mainly through the financial and trade channels James et al 2008. Consumer sentiments were also adversely affected.

During the Asian financial crisis Malaysia faced a large depreciation of the ringgit and massive capital flight even though it raised domestic interest rates. Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the bursting of the United States housing bubble culminated in. Impact on Finance Capital Flows Like other Asian countries Malaysia suffered capital flight since the second quarter of 2008.

The outcome surpassed IMP3 targets and raised confidence among services businesses. The purpose of the research is to investigate the impact of global financial crisis 2008 on banking industry in Malaysia. This paper would present a brief design of the 2008s financial crisis.

As with most of the East and Southeast Asian economies the impact of the global economic and financial crisis on Malaysia has been felt largely through a contraction in aggregate demand caused by a collapse in exports either directly or indirectly to the United States. It had inflicted profound damage on US financial system and economy. Since the crisis is a recent development and is still unraveling there is a.

8 CONCLUSION Malaysia was the one among the affected countries by the AFC in 1997 and therefore the GFC in 2008. The crisis originated in Thailand and was mainly restricted to Asian countries. To stem this outflow and depreciation the government fixed the value of the ringgit at RM38 to.

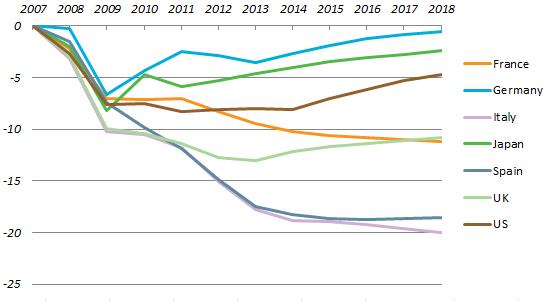

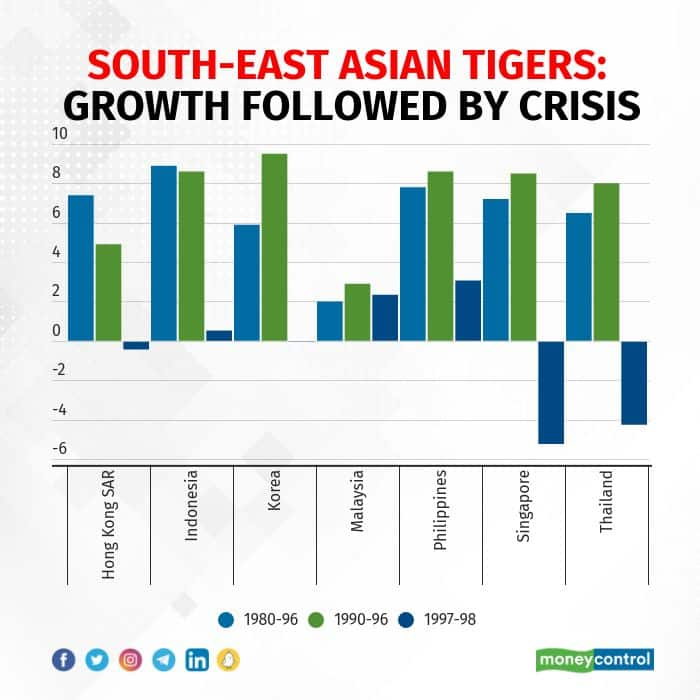

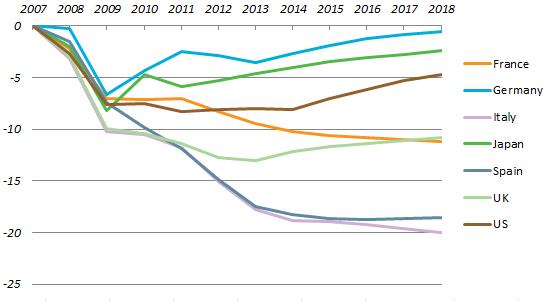

This section will focus on the causes of the 2007-2008 global financial crises which have sent virulent vibrations throughout various sectors of crisis-hit economies. Department of the Treasury. Results show that after the 199798 Asian financial crisis potential output in Hong Kong China.

The second worst after the Great Depression 1929 is the global financial crisis 2008 when banking sectors mortgage and insurance firms was. It was the most serious financial crisis since the Great Depression 1929. The primary crisis triggered the deterioration of the economy of the Malaysian people which caused GDP to fall to 736 in 1998.

The 1997 Asian financial crisis had devastating economic political and social impacts on Malaysia. Losses in other countries have averaged about 40. From October 1 the SP fell 251 points losing 216 of its value in just nine days time.

Malaysia S Journey To Become The Next Asian Superpower World Finance

A Quarter Century After The South East Asian Economic Crisis Is South Asia Following Suit

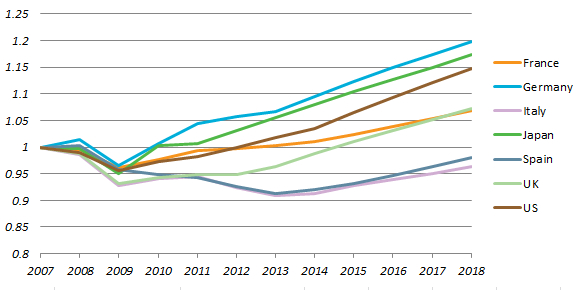

The Recovery From The Global Financial Crisis Of 2008 Missing In Action Euromonitor Com

Malaysia S Journey To Become The Next Asian Superpower World Finance

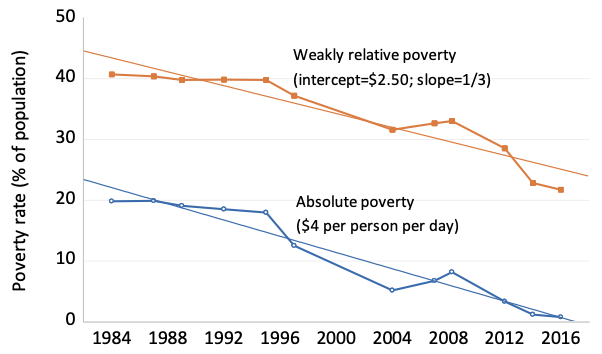

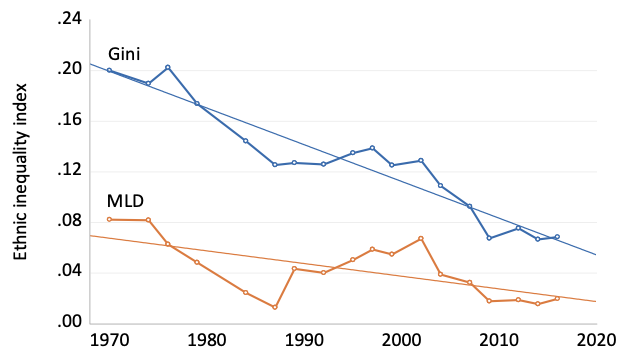

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Malaysia S Journey To Become The Next Asian Superpower World Finance

Asian Financial Crisis Of 1997

Cover Story Lessons From The Last Three Major Economic Crises The Edge Markets

The Recovery From The Global Financial Crisis Of 2008 Missing In Action Euromonitor Com

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

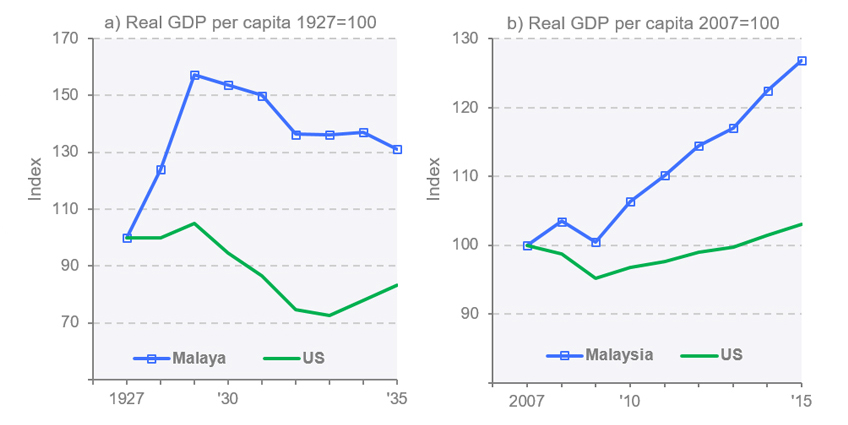

A Tale Of Two Crises Great Depression And The Great Recession Articles Economic History Malaya

The Recovery From The Global Financial Crisis Of 2008 Missing In Action Euromonitor Com

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

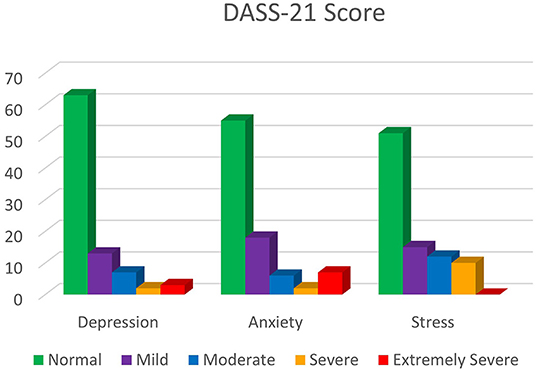

Frontiers Promoting Mental Health During The Covid 19 Pandemic A Hybrid Innovative Approach In Malaysia Public Health

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal